BROAD EMPLOYEE OWNERSHIP

Explore the Power of Employee Ownership

A win for business owners, employees, and the future.

Employee ownership is a business model and exit strategy that benefits everyone involved. By transitioning ownership to your employees, you can sell your business on your terms, strengthen the company for years to come, and preserve your legacy. It’s also a pathway to shared prosperity that supports long-term growth, employee engagement, and community stability.

Sell on Your Terms

At a Fair Price

Exit with confidence, knowing your business is in good hands.

As a business owner, you’ve worked hard to build something meaningful. When it’s time to move on, you deserve a transition that honors that legacy—while delivering fair market value.

Employee ownership offers a flexible, competitive sale option that can be tailored to your timeline and goals. It also comes with powerful tax advantages that can benefit you, your business, and your employees.

Whether you plan to step away completely or stay involved in a new role, employee ownership ensures continuity, protects jobs, and preserves what you’ve built.

Optimize Operations

Empower Your Team, Elevate Your Business

Turn employees into stakeholders and build a stronger, more invested workforce.

When employees have a meaningful ownership stake, they show up differently. They think like owners, take initiative, and work together to improve efficiency, quality, and results.

An ownership mindset creates a culture of accountability, pride, and innovation, leading to smarter decisions and stronger performance.

By aligning company success with employee success, ownership drives engagement from the ground up, making your business more competitive and resilient.

Achieve Greater Cash Flow

Fuel Growth from Within

Stronger financials start with shared ownership.

Employee ownership can dramatically improve your company’s financial health. When employees are invested in outcomes, they drive growth, and the business can benefit from significant tax advantages in return.

These benefits often translate to increased cash flow, giving you more room to invest in expansion, innovation, or long-term planning.

It’s a financial strategy that benefits your bottom line, strengthens your entire team, and positions your business for lasting success.

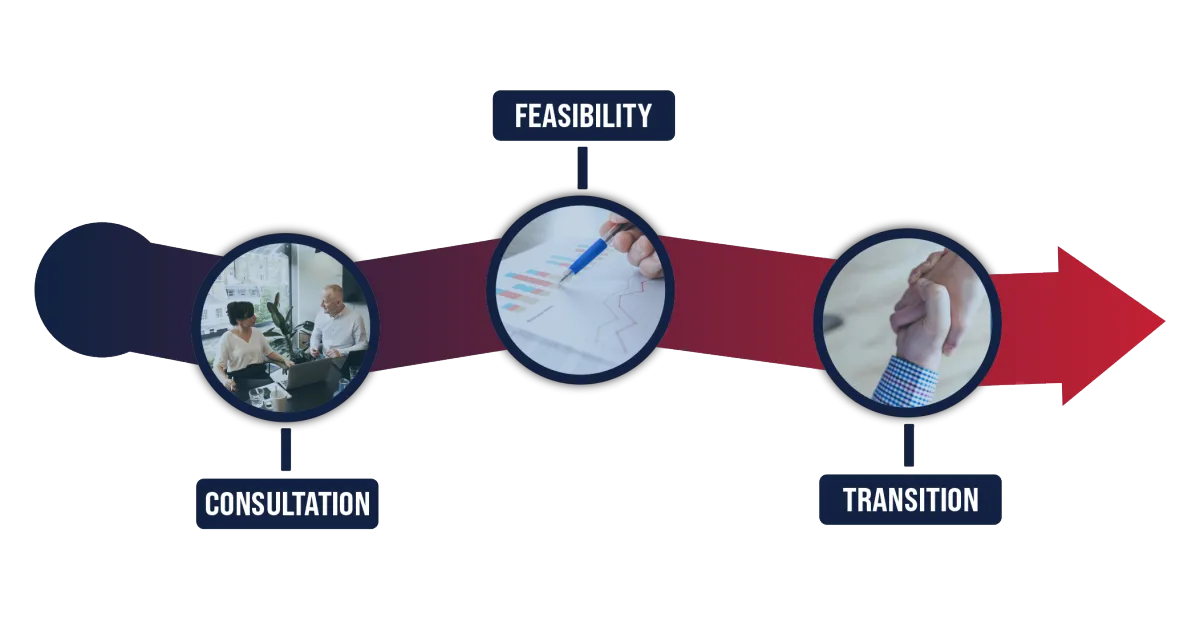

The Pathway to Employee Ownership

Your journey, your terms—MNCEO is here to guide you.

Transitioning to employee ownership doesn’t happen overnight, but with the right guidance,

it can be a smooth and rewarding process.

If you’re exploring options for a future exit, looking to increase employee engagement,

or building a new employee-owned business from the ground up, MNCEO is here to help you take the next step with confidence.

Our process is flexible, practical, and customized to your goals. We’ll guide you from the first questions to the final handshake, connecting you with trusted experts along the way.

Consultation

Understand your options, explore the possibilities.

Not sure where to begin? That’s where we come in.

MNCEO offers free, unbiased guidance to help you understand the different models of employee ownership.

Employee Stock Ownership Plans (ESOPs), Worker-Owned Cooperatives, Employee Ownership Trusts (EOTs),

and more. We’ll help you assess your goals, values, and vision for the future, so you can choose a model

that’s the right fit for your business and your team.

Feasibility

Assess your readiness and your best path forward.

Is employee ownership a good fit for your business?

During this stage, we’ll help you evaluate key factors like your company’s financial health, size, culture,

and long-term goals. You’ll also learn which ownership model makes the most sense,

and what a realistic sale price and timeline might look like. If the timing isn’t right,

we’ll help you plan for a future transition on your terms.

Transition

Design the deal, structure the sale, and secure your legacy.

Once you’re ready to move forward, MNCEO connects you with experienced legal, financial, and transaction professionals to guide the process. Together, we’ll help you map out the structure of your deal, review financing strategies that make the sale fair and viable, and determine your role post-transition. Throughout it all, you stay in control, while ensuring your business, employees, and legacy are set up for long-term success.

Types of Employee Ownership

There are three primary models of broad-based employee ownership, each with a long history of success: Worker-Owned Cooperatives,

Employee Stock Ownership Plans (ESOPs), and Employee Ownership Trusts (EOTs). While each model has distinct characteristics,

they all share one common goal: empowering employees while strengthening businesses.

Transitioning to employee ownership is about securing a fair price for your business and creating a meaningful legacy that preserves

your company’s values, ensuring long-term employee stability.

When we work with a business owner, we take the time to understand their unique concerns, priorities, and vision.

We know every business is different, so we develop a tailored transition strategy that aligns with your goals,

such as maintaining company culture, rewarding loyal employees, or continuing community impact.

Each employee ownership model has unique advantages and challenges, depending on the company’s size, goals, and industry.

Choosing the right employee ownership model can feel overwhelming, but you don’t have to manage the process alone.

Our team is here to provide guidance, help you weigh your options, and determine the best fit for your company’s future.

With our support, you can transition confidently, knowing your business is in good hands for generations to come.

Here’s a list of different types of employee ownership models,

along with their key characteristics:

Employee Stock Ownership Plans (ESOPs)

• A qualified retirement plan that allows employees to become beneficial owners of the company through a trust.

• Often used as a succession plan for business owners looking to sell while maintaining company continuity.

• Offers tax advantages for both the seller and the company.

• Employees receive shares over time and cash out when they leave or retire.

• Typically structured as a majority or minority ESOP-owned company.

Worker-Owned Cooperatives

• A business owned and democratically controlled by its employees, who each have an equal stake.

• Decision-making is typically one-worker-one-vote, regardless of employee’s role or tenure.

• Profits (called "surplus") are distributed to worker-owners based on hours worked or other agreed-upon formulas.

• Members contribute capital and share in governance responsibilities.

• Common in small businesses and service industries.

Employee Ownership Trusts (EOTs)

• A trust holds the company on behalf of employees, ensuring long-term employees benefit without direct shareholding.

• Employees don’t own individual shares, but receive profit-sharing benefits.

• Creates stability by preventing external buyers or short-term profit motives from influencing decision-making.

• Common in the U.K. and gaining popularity in the U.S.

Sign Up for

Our Mailing List

We’re on a mission to create jobs

and community wealth through

employee ownership.

TAX DEDUCTABLE DONATION TAX ID 84-4160755

Main Office - 1420 8th Ave. N, St. Cloud, MN 56303

St. Paul Office - 165 Western Ave N, Suite 8 , St Paul, MN 55102